library(tidyverse)

library(tidymodels)Apple and Microsoft stock prices

These are suggested answers for the application exercise. They’re not necessarily complete or 100% accurate, they’re roughly what we develop in class while going through the exercises.

Today we’ll explore the question “How do stock prices of Apple and Microsoft relate to each other?”

Goals

Understand the grammar of linear modeling, including \(y\), \(x\), \(b\), \(e\) fitted estimates and residuals

Add linear regression plots to your 2D graphs

Write a simple linear regression model mathematically

Fit the model to data in R in a

tidyway

Packages

Data

The data for this application exercise was originally gathered using the tidyquant R package. It features Apple and Microsoft stock prices from January 1st 2020 to December 31st 2021.

First, let’s load the data:

stocks <- read_csv("data/stocks.csv")To keep things simple, we’ll work with a subset of the data, stock prices in January 2020.

stocks_jan2020 <- stocks |>

filter(month(date) == 1 & year(date) == 2020)Models and residuals

Exercise 1

At first, you might be tempted to minimize \(\sum_i e_i\), the sum of all residuals, but this is problematic. Why? Can you come up with a better solution (other than the one listed below)?

Large positive residuals would cancel with large negative residuals.

We could minimize the sum of the absolute value of the residuals.

Minimize the sum of squared residuals

In practice, we minimize the sum of squared residuals:

\[ \sum_i e_i^2 \]

Note, this is the same as

\[ \sum_i (y_i - \hat{y}_i)^2 \]

Exercise 2

Check out an interactive visualization of “least squares regression” here. Click on I and drag the points around to get started. Describe what you see.

Each square is a “square residual”. The line minimizes the sum of squared residuals, (i.e. it minimizes the total area of squares I see on the screen).

This is called “Ordinary Least Squares” (OLS) regression.

Plotting the least squares regression line

Plotting the OLS regression line, that is, the line that minimizes the sum of square residuals takes one new geom. Simply add

geom_smooth(method = "lm", se = FALSE)to your plot.

method = "lm" says to draw a line according to a “linear model” and se = FALSE turns off standard error bars. You can try without these options for comparison.

Optionally, you can change the color of the line, e.g.

geom_smooth(method = '"lm", se = FALSE, color = "red")Exercise 4

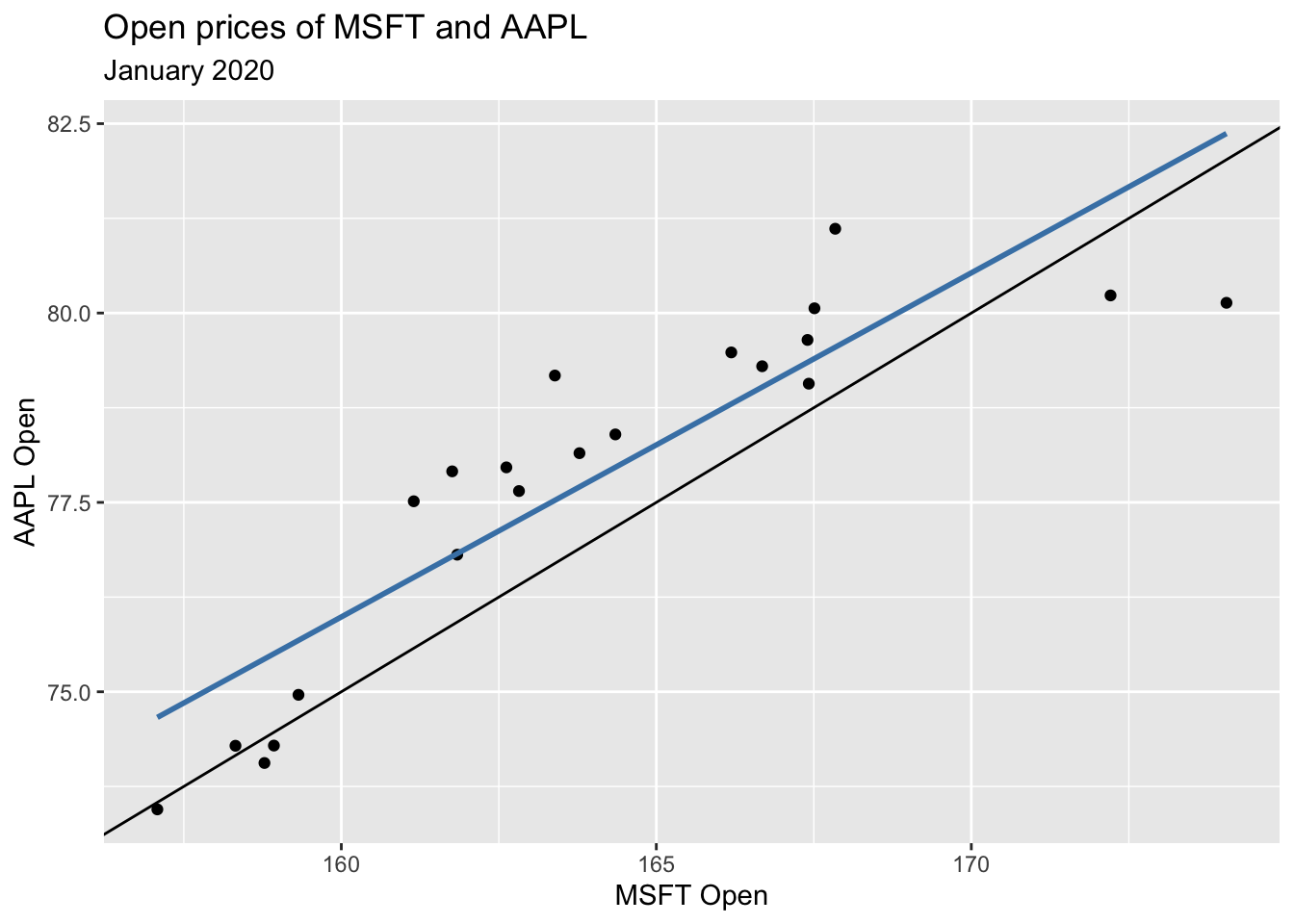

In the slides we fit a model with slope 0.5 and intercept -5. The code for layering the line that represents the model over your data is given below. Add geom_smooth() as described above with color = "steelblue" to see how close your line is.

ggplot(stocks_jan2020, aes(x = MSFT.Open, y = AAPL.Open)) +

geom_point() +

geom_abline(slope = 0.5, intercept = -5) +

geom_smooth(method = "lm", se = F, color = "steelblue") +

labs(

x = "MSFT Open",

y = "AAPL Open",

title = "Open prices of MSFT and AAPL",

subtitle = "January 2020"

)`geom_smooth()` using formula = 'y ~ x'

Finding \(\hat{\beta}\)

To fit the model in R, i.e. to “find \(\hat{\beta}\)”, use the code below as a template:

model_fit <- linear_reg() |>

fit(y ~ x, data = dataframe)linear_regtellsRwe will perform linear regressionfitdefines the outcome \(y\), predictor \(x\) and the data set

Running the code above, but replacing the arguments of the fit command appropriately will create a new object called model_fit that stores all information about your fitted model.

To access the information, you can run, e.g.

tidy(model_fit)Let’s try it out.

Exercise 5

Find the least squares line \(y = \hat{\beta_0} + \hat{\beta_1} x\) for January 2020, where \(x\) is Microsoft’s opening price and \(y\) is Apple’s opening price. Display a tidy summary of your model.

stock_fit <- linear_reg() |>

fit(AAPL.Open ~ MSFT.Open, data = stocks_jan2020)

tidy(stock_fit)# A tibble: 2 × 5

term estimate std.error statistic p.value

<chr> <dbl> <dbl> <dbl> <dbl>

1 (Intercept) 3.31 8.87 0.373 0.713

2 MSFT.Open 0.454 0.0541 8.40 0.0000000808Exercise 6

Re-write the fitted equation replacing \(\hat{\beta}_0\) and \(\hat{\beta}_1\) with the estimates from the model you fit in the previous exercise.

My fitted model is:

\[ \hat{y} = 3.3117408 + 0.4542263 x \]

where \(\hat{y}\) is the predicted Apple open price and \(x\) is the open price of Microsoft.

Exercise 7

Interpret \(\hat{\beta}_0\) and \(\hat{\beta}_1\) in context of the data.

\(\hat{\beta_0} = 3.3117408\)

It’s the price of APPL if MSFT opened at 0.

\(\hat{\beta_1} = 0.4542263\).

For every dollar increase in MSFT open price, we expect AAPL open price to increase by .45.

Bonus exercise

Say Microsoft opens at 166 dollars. What do I predict the opening price of AAPL to be?

yhat <- 3.3117408 + (0.4542263 * 166)

yhat[1] 78.71331